About ResiFund

“We launched ResiFund to help people build their wealth, to enable them and their families to enjoy their lives even more.”

We do that by investing in residential property, an investment people are very comfortable with. ResiFund is now the solution which allows virtually anyone to invest in residential property.

With housing affordability stopping so many investors getting onto the property investment ladder, we make it possible. We do that by enabling people to invest in residential property without having to borrow money and with low minimum investments

So please consider joining our hundreds of happy investors, with an investment in ResiFund’s portfolio of Australian residential property”.

Residential Property Market

Residential property has delivered an average return of 11.7% p.a in the 40 years to June 2022 and returns which were 70% less volatile than the Australian share market*.

While past performance is not necessarily indicative of future performance, we believe the long-term outlook for residential property also remains very attractive. This is because we believe the demand to buy and rent properties will exceed supply, which should result in higher property prices and rents, much as it has for the last 40 years**.

What ResiFund Offers

ResiFund allows our clients to easily and yet professionally invest in residential property, with key benefits including:

- No requirement to borrow money

- Investment from as little as $5k

- Targeting total returns of 10% p.a (after fees/costs but before tax)

- Investment in all ResiFund properties throughout Australia

- ResiFund takes care of all aspects of your property investment

- Investing alongside arguably Australia’s most successful residential property group, which is licenced by ASIC

- Opportunities to sell (redeem) your investment each year***

- Becoming an investor in only 10 minutes

* Source RIA

**Past performance is not indicative of future performance

*** See PDS for specific terms and conditions for its different investment options

How does ResiFund work and how do I get returns?

ResiFund is very similar to a normal property investment. We generate income (rents) from our large portfolio of tenants and we try and achieve capital growth in the value of the properties we own. As an investor, you receive a share of all of the income and capital growth of all of our properties.

Please see below the following brief introductory webinars about how ResiFund works.

ResiFund already has hundreds of happy and successful investors, who have invested from $5k to $1m and include:

- First time investors who could not afford to buy an investment property

- SMSF’s looking to invest in a diversified residential property portfolio

- Professional investors who saw ResiFund as a better alternative to buying an investment property

- Financial advisers, as ResiFund has been Independently Rated

- Retirees looking for regular income and the potential for capital growth, in a type of investment they feel very comfortable with.

Please take a few minutes to watch testimonials from an existing client.

What type of investment is ResiFund?

ResiFund is what they call a property fund or managed fund. In simple terms, property funds pool investors’ money together to allow them to invest in a large portfolio of properties that they couldn’t afford to own themselves. Investors have an investment in every property, providing them with much more diversification than they could achieve themselves.

Property funds are used by many of the largest super funds in Australia as a way to invest in property, including in Office buildings and Shopping centres.

ResiFund allows both small and large investors to invest in property, without having to borrow money or manage the properties themselves. Each investor has an investment in all of the properties in the Fund as well as in new properties we acquire.

How do I get returns?

ResiFund is just like a normal property investment.

We generate income (rents) from our large portfolio of tenants and we try and achieve capital growth in the value of the properties we own.

- Income returns can be paid to investors quarterly, or they can elect to reinvest that income into additional units into ResiFund.

- Capital growth is achieved when the market value of our properties increases. Investors buy units (similar to shares) in ResiFund, at a price which reflects the current value of the properties. As property values increase so does the unit price. When an investor sells or redeems their units, the amount they receive reflects the value of the properties at that time.

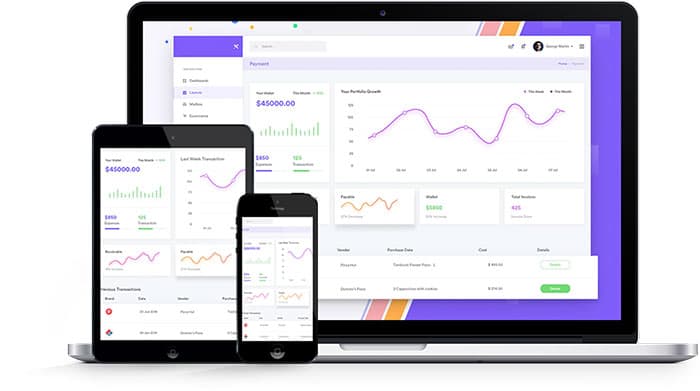

How do I start an investment and then see how it is performing?

Investment is through our Product Disclosure Statement. Applications to invest are made online using our ResiFund Application, which should only take about 10 minutes to complete.

Investors are then allotted units in ResiFund and receive a Unitholder certificate, similar to a shareholder certificate

You will then also receive your own Investor Portal link to track your investment, as well as Quarterly Newsletters and annual market value and tax statements to easily manage your investment.