We warmly welcome the significant number of new investors who joined the ResiFund community this quarter. We hope you and our existing members enjoy this newsletter.

Investor Newsletter October 2019

Your Property Portfolio Update

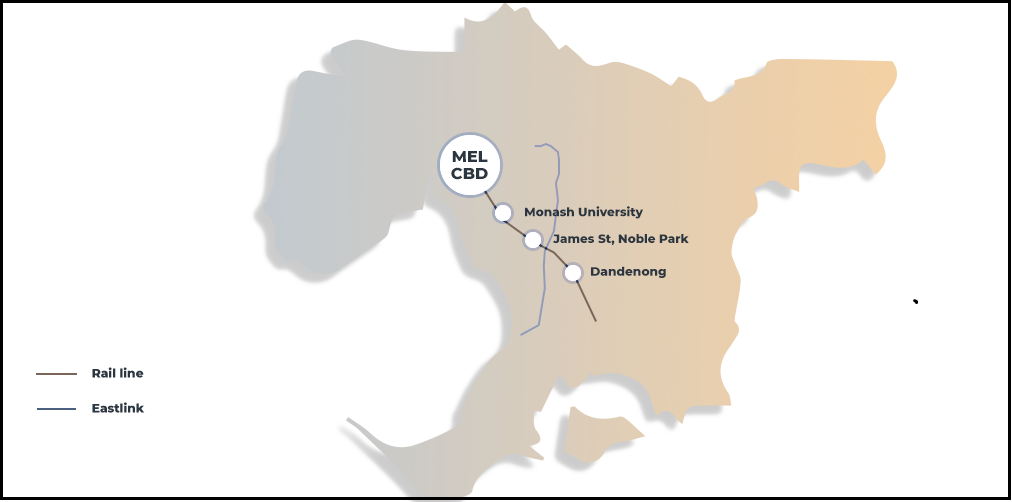

Since our last Newsletter we have made further significant progress for you, with the acquisition of a property located in James Street Noble Park, less than 500 metres from the Noble Park Shopping Centre in Melbourne.

Noble Park is 25 km south-east of Melbourne’s CBD, near the Dandenong and Mulgrave business centres, as well as a number of major retail centres and hospitals, providing significant employment opportunities and amenities for our future tenants.

The site has an existing house which will be demolished and replaced by the construction of an expansive two storey dwelling, containing nine studio-style apartments. Each resident will have a private kitchenette and ensuite plus the benefits of a shared kitchen, laundry, dining room and security features. All studios will be furnished and will have internet and utilities included as part of the weekly rent, making them very attractive and easy for tenants to quickly lease.

These small, multi-tenancy dwellings focus on single occupants. Based on our research, similar dwellings around Noble Park rent for $280-$320/week and we have budgeted to lease our properties at the low end of that range. Once leased we anticipate further rental growth over time, with rents for 1 bedroom properties across many of Melbourne’s middle-ring suburbs increasing over 5% in the last twelve months (Source: Rental Tenancy Bond Authority). This strong rental growth reflects the significant shortage of this style of affordable accommodation. Consistent with this, the rental vacancy rate for properties in Noble Park is extremely low at only 1.2% (Source SQM), which should ensure the property will be quickly leased.

The total cost of the land and building will be approximately $1.5 million, and should generate net income of $51,256/year on the total cost. By our calculations this will generate 6.6% p.a net income return (after interest, fees and costs) which will be passed through to investors, along with any other income, by way of quarterly income distributions.

We are also very pleased to advise that we have now received an independent valuation of the property, based on what’s called an “as if complete” basis. This is essentially the valuers view of what the property will be valued at once we complete construction and fully lease the property. That has provided a valuation which is 16% higher than the cost to buy the land and construct the property. Allowing for gearing of 50%, that 16% increase should result in 32% capital growth for investors for this particular property. As a result, we will steadily increase our unit price further to reflect that anticipated growth, so that investors can immediately benefit from the value we are creating. We expect construction to start in October 2019 and to be completed in approximately May 2020.

It is also noteworthy that while we are seeking to deliver excellent returns for our investors, we are also increasing the availability of more affordable housing, which is a major issue across many of Australia’s metropolitan areas. This shortage of affordable housing options is expected to worsen in coming years which we anticipate will create further demand for the Fund’s multi-tenancy properties.

As ResiFund is receiving new investments every month we will shortly commence sourcing our next acquisition opportunity for all our investors to benefit from. In the short term, we will focus on further small multi-tenancy acquisition opportunities in Melbourne’s inner north-east and eastern suburbs, as well as consider investments in Specialist Disability Accommodation (SDA) for the National Disability Insurance Scheme, as we discussed in our previous Newsletter.

Asset Allocation And Diversification

Once the Fund’s current properties are completed and leased you will have investments across Melbourne and Brisbane and leased to 14 tenants. This provides much greater diversification and lower risk than the traditional investment strategy of buying a single rental property.

Your Investment Returns

ResiFund aims to outperform the residential property market and give you an average total return of 10% per annum over the medium to long term.

These returns will generally comprise a combination of income returns generated from the net rent we receive, which is paid to you as income distributions, and through capital growth in the value of the properties, which is reflected in your monthly unit price.

In this first year of the Fund’s operation, the returns will primarily be generated from capital growth. Thereafter, investors will also start to receive income returns once our properties are built and leased, likely to be in the first half of 2020.

As most of our members would know, there has been a lot of press over the last year concerning house prices being flat or even negative in some locations. Across the country house prices declined, on average, around 6.4% (Source: Corelogic) in the year to July 2019. It is important to note that such returns ignore any rental income received, which is a major focus of ResiFund, and also varies significantly across different locations with the median house price in Canberra increasing by 1.1% while Sydney house prices fell 9%.

To generalise, the recent slowdown in capital growth was largely due to lower demand to buy houses, following concern regarding the potential removal of negative gearing, combined with the difficultly in securing bank loans. In addition, our view is that as bad news stories sell better than good ones, this also led to a lot of negative, unbalanced and often sensationalist news stories which ignored investment fundamentals and further reduced buyer confidence and demand.

More recently, we have seen that with negative gearing being retained, APRA allowing banks to move back to more accommodating lending criteria, and the RBA cutting interest rates multiple times, sentiment and therefore demand has again improved. This has so far been reflected in higher auction clearance rates.

Despite the relatively flat performance of the market in general, ResiFund is on track to achieve around a 10% return for investors over the first year. This represents a substantial out-performance of the market and reflects our focus on buying well and seeking to add significant value to properties, thereby reducing our reliance on market price escalation, to generate good returns. While we anticipate we will see growth across houses prices re-emerge selectively over the next year, that will essentially just enhance the returns we are on track to generate.

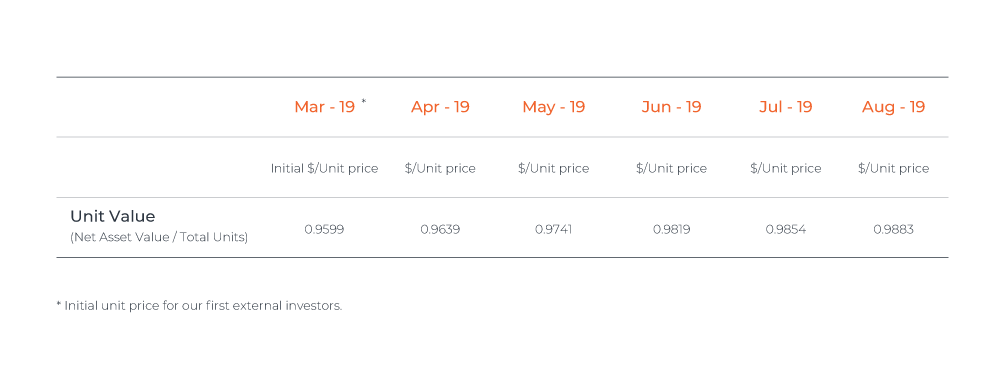

The table below shows our unit price rising steadily from when we first issued units to external investors and reflects the value we are adding for members from our property acquisitions and enhancements.

Market Update

We will shortly post our September Quarterly Market Report on our YouTube channel: ResiFund YouTube

Region Review: Noble Park (South-East Melbourne)

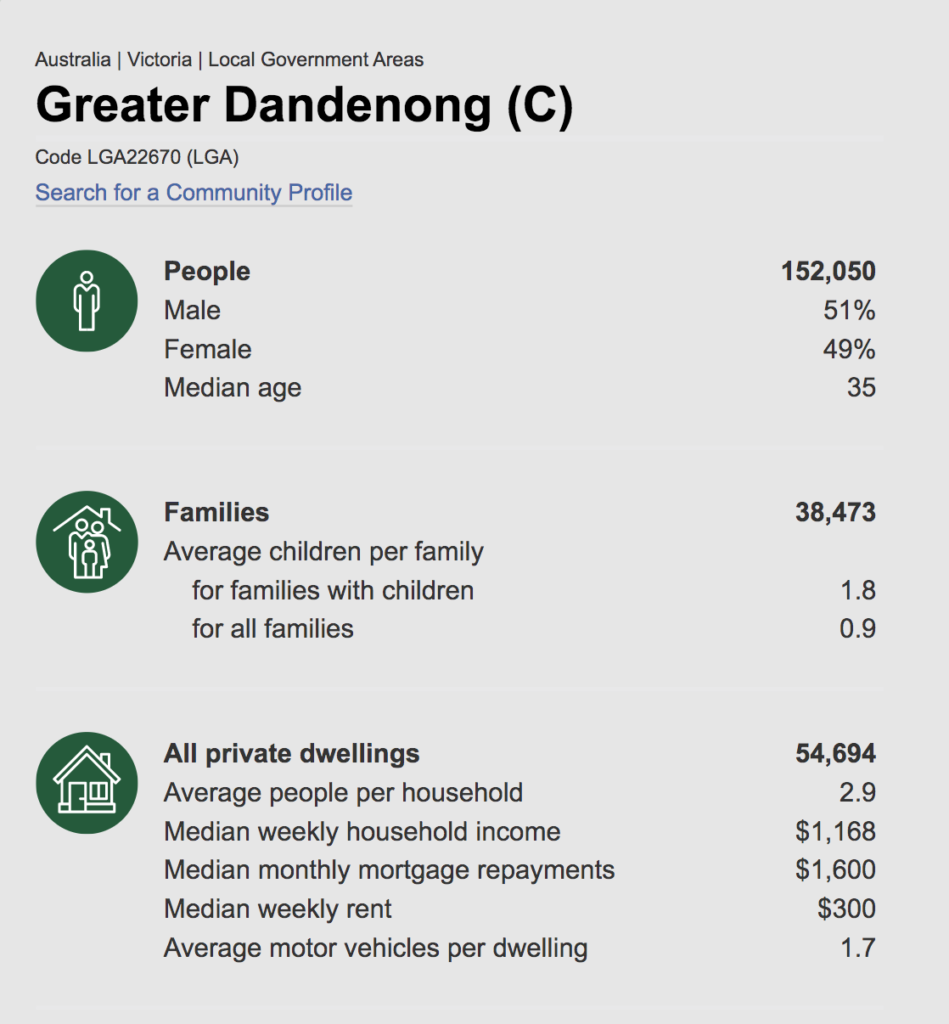

Our recent Noble Park purchase is in the City of Greater Dandenong around 25 km south–east of Melbourne’s CBD.

Noble Park is a highly multi-cultural suburb and is considered a traditional “working class” area.

There has been substantial investment in the Noble Park area over recent years by local and state governments, including a new community complex, redevelopment of the railway station and development of a substantial Aquatic centre.

The James Street property is;

- A 6 min walk to Noble Park Shopping Centre and 10 min walk to Noble Park train station.

- Close to major employment hubs of Dandenong (8-10 minute drive) and Mulgrave (15 minute drive).

With the benefit of the governments investment in infrastructure Noble Park is transitioning rapidly as new residents move in, replacing old homes with large modern houses. The vacancy rate is also very low at 1.2% (Source SQM), compared to the Melbourne average (1.6%), therefore providing good potential for rental and capital growth over time.

Noble Park forms part of the City of Greater Dandenong which is currently undergoing a major transit oriented urban renewal, first planned in the Victorian Government’s Melbourne 2030 strategy.

The industrial precincts of Dandenong form part of one of Australia’s most significant and productive manufacturing areas; and Central Dandenong has long been considered Metropolitan Melbourne’s second city centre. Greater Dandenong is a major source of employment for the whole South East Region of Metropolitan Melbourne and beyond.

Dandenong has seen significant construction over recent years with the construction of a new Tax Office and will shortly see construction of a new Holiday Inn Hotel complex of 160 rooms (see artists impression below).Dandenong is also the beneficiary of a $290 million State Government funded revitalisation initiative. Dandenong also provides local businesses with access to world class research facilities including the Monash Innovation Precinct.

As Melbourne’s population grows and the urban sprawl expands, activity centres like Dandenong are becoming a much more significant focal point for residents. These activity centres not only attract lots of small to medium service-based businesses, but they also have a significant amount of public and social infrastructure.

As these urban centres are transformed with new amenity and public spaces it will likely precipitate the need for a diverse range of housing. This transformation, which has only recently begun to take shape, is likely to influence house prices and rental demand in the region for decades to come.

Some Insights Into ResiFund’s Acquisition Strategy

Contrary to common belief, housing in “blue chip” suburbs does not always present the best investment case. While famous blue chip suburbs can often lead the way in favourable conditions, they can also be the fastest to decline when lending conditions are tight.

During the recent house price downturn, the suburbs most affected in Sydney and Melbourne were those in the top quartile (most expensive). For example, the median house price in Toorak, traditionally Victoria’s most expensive suburb, dropped 36% from its peak in 2017 to its current median house price.

It has been our experience, having acquired over 1,000 properties, that a deep understanding of property fundamentals can assist in maximising investment returns in the residential market. We have seen that value is often created when suburbs go through a transition period, initially started by substantial infrastructure investment. This new infrastructure leads to a change in demographics and old homes are replaced with new as younger families move into the area. The improving quality of housing lifts the desirability of the area. Young families also increase the demand on schools, health care, child care, and retail. This creates new jobs which, again, increase demand for housing.

Another key consideration in our investment decisions is the rental market. Specifically, the rental yield (income relative to the price of the property) and rental vacancy rates, which is an indication of rental demand. These affect the net income that can be derived from a property. Suburbs with low vacancy rates, such as Noble Park which currently has a vacancy rate of 1.2%, benefit from more competition between prospective tenants for properties that are offered for lease. The sooner a property is leased the sooner income is generated.

The median weekly rent for houses in Noble Park lifted 2.7% in the 12 months to June 2019. This may only be a modest increase but it defies the trend observed in many of Melbourne’s traditional blue chip suburbs. By way of contrast, the vacancy rate in Toorak (one of Melbourne’s most expensive suburbs) in Melbourne’s inner east, is currently 3.3% and rental income for houses in Toorak has dropped 12% over the 12 months to June 2019. The fall in rental income is partly driven by what we perceive to be a relatively higher level of difficulty experienced by landlords to find tenants in Toorak, which has a higher vacancy rate of 3.3%, compared to average vacancy rate in Melbourne at 1.6% or in Noble Park at 1.2% (Source SQM). This trend of falling rents is consistent with many of Toorak’s neighbouring suburbs.

While there are obvious differences between Toorak and Noble Park, the median house price in Noble Park has averaged 7.37% per annum growth over 10 years, which is substantially higher than Toorak’s 2.99% per annum average. To put this in perspective, Noble Park outperformed Toorak by 69% over the last 10 years, based on our calculations of changes in median house prices for the respective suburbs ( Source for raw data: www.realestateinvestar.com.au/Property/noble+park). That’s also before taking into account the more favourable rental yield and vacancy rates.

From our point of view, while there are various factors at play affecting median house price growth or decline, Noble Park’s out-performance of Toorak’s median house price is down to demand and supply of dwellings at prices that are affordable for those that are seeking to acquire them. While there are certainly more people that would like to live in a premium inner-suburban suburb, such as Toorak, as opposed to a middle-ring suburb like Noble Park, there are very few that can actually afford to buy a property in Toorak or a property priced above the median house price. On the other hand, with Noble Park’s median house price being below the median house price for the Melbourne metropolitan area, it stands to reason that more property buyers in the Melbourne market could afford to buy in Noble Park. Therefore, as the amenity of the area improves it attracts a greater share of these buyers which we have seen as a driver of median house price growth.

Over time we hope to share more of our investment philosophies with you to help you understand the thought process behind our acquisition decisions. It is this deep knowledge of property markets that we put to use each day, focusing on long term growth and sustainable rental income for your ResiFund property portfolio.

And just to ensure we are not offending our Toorak readers, for the record: Toorak is a beautiful suburb, one of Melbourne’s best, but not one where we will be investing in the immediate future.

Who’s Investing With Us & How?

Our members comprise people of various backgrounds, in different life stages, investing directly or via their SMSF.

Marion recently invested in the ResiFund and was featured in a brief segment on Channel 7.

ResiFund has also recently received media coverage from the Herald Sun in Melbourne.

ResiFund: new way to get into market for as little as $1000

Thanks for reading!

We hope you found this newsletter informative.

We look forward to bringing you more updates in our next quarterly newsletter.

Director and ResiFund Investor

To learn more contact:

Retail investors:

Anne-Marie Threlfall, Investor Relations Manager, on 1300 999 881 or annemarie@resifund.com.au

Wholesale investors and Financial advisers:

Warren Boothman, Head of Property Capital, on 1300 999 881 or warren@resifund.com.au

ResiFund: AFSL 417371

Disclaimer

ResiFund (ABN 38 154 921 730; AFSL 417371) wrote this summary for general information purposes only.

While we took all care re the information’s accuracy, we give or imply no warranty as to its fairness, completeness or accuracy.

Nor does it substitute a Product Disclosure Statement (PDS) or Supplementary Product Disclosure Statement (SPDS) or any other notice the Corporations Act requires.

Investor tax rates aren’t factored in calculating returns. Past performance doesn’t indicate future performance. Returns and values may rise and fall from one period to another. The information shouldn’t be the sole basis of an investment decision. We suggest you obtain the appropriate professional advice before making a decision to invest.