WORRIED HOW YOU’RE GOING TO FUND YOUR RETIREMENT?

Use The High Income From This Debt Free Property Investing Method To Help Fuel Your Dream Retirement

Reserve Your FREE Real Estate For Retirement Consultation To See How ResiFund Could Help You Achieve Your Dream Lifestyle In Retirement

Get Rid Of Your Debt And Replace With High Income Producing Property To Help Fuel Your Retirement

Are you worried you won’t be able to afford the life you want in retirement? To travel regularly and enjoy the luxuries in your golden years? Or even maintain a comfortable lifestyle without relying on the pension? Then you’re in the right place.

ResiFund allows you to enjoy all the benefits of property investing without using debt. This may allow you to build wealth and draw regular income at the same time. ResiFund was designed to be the antidote to highly leveraged, low income generating property investments.

How Does It Work?

Find out the unique approach we’ve brought to Australia to build diversified portfolios for our clients.

Find Out How To Grow Your Property Portfolio Without Committing To Another Mortgage!

ResiFund Is A Member Of The OpenCorp GroupAs Seen In

Who Are ResiFund & Where Did We Come From?

Our director’s, Allister and Matthew Lewison, passion for property was sparked in the 1980’s when their father took them on the journey as he started building his own multi-million dollar property portfolio.

This unprecedented education into property investing has seen them go on to build their own successful portfolios and careers in property, with Allister being recognised by BRW Magazine as the 4th wealthiest self-made property millionaire under 40 years of age in 2017 and Matthew becoming General Manager of a publicly listed company at just 26 years of age, responsible for a development portfolio of more than 14,000 residential lots worth more than $2 billion on-completion.

Teaming up with Cam McLellan (Bestselling Author of ‘My 4-Year-Old the Property Investor) the trio founded ResiFund’s sister-company, OpenCorp – which has become one of Australia’s leading residential property investment specialists. We have more than 33 years of property market expertise and 1000’s of clients who we have helped to purchase some $1.2 BILLION+ worth of real estate.

Matthew Lewison

Allister Lewison

Cam McLellan

Find Out How To Deleverage Your Portfolio & Begin Earning Positive Cash Flow In Retirement!

Steadily Grow Your Wealth Using The Most Reliable Asset Class Of The Last 30 Years

Are you like the many hard-working Australians that have grown their wealth over decades and are now particularly interested in protecting their nest-eggs? Investors approaching retirement, or who are transitioning to a carefree lifestyle, often wish to get a decent return on their capital while trying to avoid exposure to high risk investments.

With ResiFund we exclusively invest in a diversified range of residential property. This has been the most stable and reliable asset class over the past 3 decades to 31/3/2018 – returning an average of 11.4% over this time frame.

Our Low Risk Appoach To Investing In Residential Property

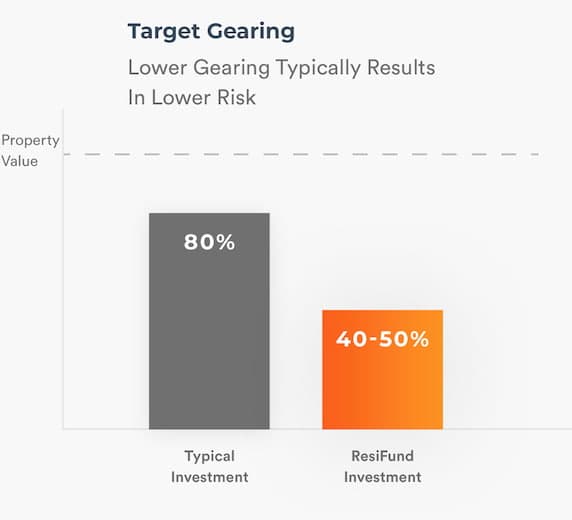

We believe that the lowest risk approach to investing in residential property is to maintain low gearing, focusing on positive cashflow property that is underpinned by strong tenant demand, often linked to low vacancy rates, and to diversify the portfolio across many cities and property types.

It’s a model that has proven successful to many of Australia’s most prolific investors, including our directors, and with ResiFund you have the chance to invest right alongside them.

The ResiFund Team In The Media

We’ve Helped 1000s Of Aussies Create Millions Of Dollars Through Property Investment. Here’s What Our Happy Clients Have To Say

One of the first funds I did with ResiFund I got 11% per year, over two years, so I got 22%. So I DOUBLED what I would have got with CBUS in the same period of time… It’s a no-brainer. Feels like you are part of building something, and you’re getting good returns with your money. Callum

Callum

Gerard

Selena

4 Steps To Your Highly Profitable ResiFund

Find Out How ResiFund Can Help You Achieve Your Goals During Your Free Property Consultation

Find Out How ResiFund Can Help You Achieve Your Goals During Your Free Property Consultation We understand the importance of being well informed before you make investment decisions. That’s why we’ve taken the time to provide information that will help you understand ResiFund so that you can decide if it is the right vehicle to help you transition to carefree living. And of course, we’d also love to answer any questions you might still have.

Secure Your Initial ResiFund Investment

Secure Your Initial ResiFund InvestmentOnce you’re happy with everything and submit your application form, we’ll create a ResiFund account for you and secure your initial investment amount – this is where your exciting journey begins!

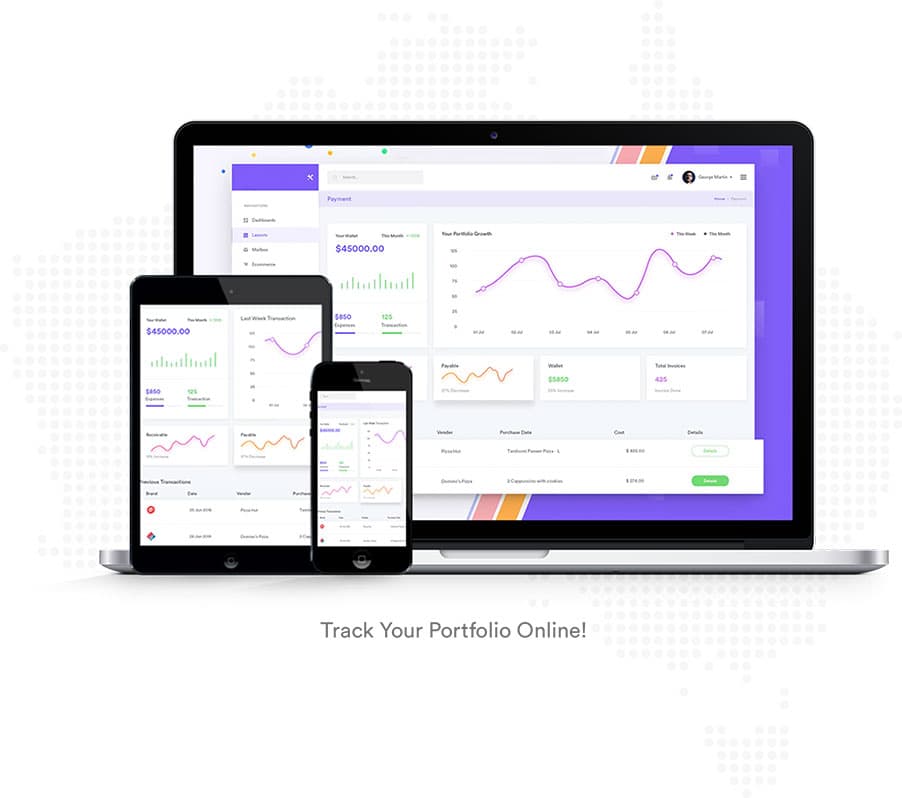

Check Out The Progress Of Your Property Portfolio

Check Out The Progress Of Your Property PortfolioIf you want to reach your financial and lifestyle goals faster, you can always make additional deposits into your ResiFund to help supercharge your returns! We also provide a distribution reinvestment plan, allowing you to benefit even more from the compounding effect.

Supercharge Your ResiFund Returns

Supercharge Your ResiFund ReturnsEven though you’ll now be part owner of properties spread all over Australia, you’ll barely have to lift a finger because we manage everything from start to finish. We’ve tried to make it so simple all you should ever need to do is stay tuned as we work hard to grow your wealth for you.

Find Out How To Deleverage Your Portfolio & Begin Earning Positive Cash Flow In Retirement!

Not Ready To Invest Yet?

If you want to learn more about ResiFund’s co-investing strategy, and how it could potentially help you to retire sooner, simply click the button below to sign up for our free consultation which reveals:

- The 3 traditional exit strategies most property advisors will tell you, and why these may not work for most people

- The little-known secret to eliminate mortgage debt and finally start earning an income from equity

- If your current property ownership structure has this one thing, it could be diminishing your retirement savings – and how to fix it. It’s not too late!

- The 7 simple methods to reduce your exposure in a property downturn – failing to implement these can see you losing $100,000s in equity!

- The one simple lifestyle change now to start transitioning into a carefree lifestyle – this can happen 5, 10, or even 20 years before the ‘normal’ retirement age

Awards & Recognition

Co-Invest Alongside Our Experts As We Build Your Diversified Property Portfolio

It wouldn’t really be right if we didn’t believe in our service enough to invest in ResiFund beside you. That’s why we were the first investors to put our own money in.

You should be able to invest in complete confidence knowing that the managers interests are aligned with your own. You’ll be part owner of the same property portfolio that our directors own a stake in so we hope that you can rest assured that we will be working hard to deliver great returns.

As we have achieved for other clients, we aim to have over 1,000 properties within the fund and like us you can own a share of all of these properties, starting with just $1,000. Speak to us today to see how you can get started in this ground-breaking opportunity.

Achieve Financial Security In Retirement And Leave Your Family A Lasting Legacy

For many of us, simply growing wealth for our own sake isn’t the only motivator. We all want to live a comfortable, fulfilling lifestyle before and during retirement. However, many of us also want to be able to assist our children and grandkids – and leave a legacy which continues to help them many years after we’re gone.

ResiFund is designed to help you achieve this. To start the process, you can open your account, decide whether you want to reinvest your returns or take a regular cash distribution. You could even set it all up within your SMSF which might have additional tax benefits.

Our Incredible Results Speak For Themselves…

Over the past 10 years we’ve sourced well over 1000 properties for our clients. In this time, we’ve achieved an average return of 10.8% p.a. across all our direct property client’s properties completed before 31/03/2018, including rent and capital growth on an ungeared basis. This is FAR higher than the average total return from the Australian residential real estate market index which was 6.8% over the same time span, without even factoring in the development profits of Open Corp’s development funds and managed investment schemes, where Open Corp is the responsible entity and trustee of registered and unregistered managed investment schemes. We aim for ResiFund to bring you a return of AT LEAST 2% p.a above the market average.

1985

when our market

expertise began

900+

Properties Under

Management

$100m+

Capital growth of

properties sourced

by OpenCorp

1,589+

clients we have helped build wealth with property

At Least 2% p.a.

Above Market Average

$1.2 Billion+

of real estate transactions

Here’s A Sample Of What You’ll Discover When You Sign Up For Your Free Consultation…

How To Invest In Property Without Committing To A Mortgage

How To Invest In Property Without Committing To A Mortgage

Sick of dealing with the banks and taking on more debt when you invest? We’ll reveal exactly how ResiFund can remove the middle man An Easy Way To Build Wealth With Residential Real Estate

An Easy Way To Build Wealth With Residential Real Estate

We’ll reveal our simplest way for you to build wealth like a leading expert with decades of experience – even if you only have one property so far Why You Should NEVER Again Be Fooled By An “Armchair Expert”

Why You Should NEVER Again Be Fooled By An “Armchair Expert”

Everybody has an opinion about property. Very few actually have an in-depth knowledge of how our property markets work, but those that do seem to make money from property almost effortlessly. We’ll tell you how to find valuable information on investing and block out the white noise How ResiFund Can Fuel Your Retirement With Passive Income

How ResiFund Can Fuel Your Retirement With Passive Income

You might need an income source to help fund the lifestyle you want in your golden years – we’ll show you how ResiFund can help you do this The Easy Way To Invest In High-Income Producing Properties Within Minutes

The Easy Way To Invest In High-Income Producing Properties Within Minutes

It usually takes months of research and negotiation to secure a high yield, growth property – we’ll show you how to do it in less than 30 minutes!

Find Out How To Deleverage Your Portfolio & Begin Earning Positive Cash Flow In Retirement!

ResiFund Is Like Investing In A Property Trust Similar to Westfield, Only For Residential Property

When investors bought an interest in Westfield, they were putting their money into a property trust alongside other investors, including the Lowy family who were Westfield’s directors. The directors oversaw the management of the property portfolio, and over an extended period their investors received a considerable return based on the overall performance of the property trust.

While all property trusts have different investment strategies, management experience, and performance, they often share the same tax advantages that can benefit investors.

A Unique Aussie Property Investment Strategy

ResiFund’s investment strategy is focused on residential property and may be completely unique in Australia but one critical thing that ResiFund has in common with Westfield is that the directors are heavily involved in the investment process and have a deep passion for property.

When you invest in ResiFund you are investing in a property trust, alongside other investors including ResiFund’s directors. The added bonus is that residential property has historically been less volatile than commercial buildings such as shopping centers.

Invest With Our Founders

Leverage Tax Advantages

Use Residential Property

Diversify Your Portfolio

Need To Know More? These Are The Questions Our Clients Ask Us The Most

How does ResiFund Work?

ResiFund’s expert property team buys real properties. These are located across Australia, generally located in major capital cities.

When you invest in ResiFund you are becoming a part owner of all of the properties in ResiFund’s portfolio and are entitled to a share of the income and capital growth from all of the properties.

You get to piggyback off the experience of the fund manager, whose directors have 30 years experience and are some of the most successful residential property investors in Australia. Not only do they manage ResiFund but they are also currently the largest investors in ResiFund so you get to invest right alongside them. This can reduce your risk and means you have an expert on your side who has “skin in the game”, is aligned with you and is contactable throughout your investment journey.

Every quarter ResiFund will pay your share of the net rental income (after costs and fees) to you in the form of an income distribution. You can choose to either reinvest this distribution or take it as a regular payment. And as property values go up you also benefit from the price growth, keeping you one step ahead of the market.

You’ll have an online portal where you can login and see your investments details, property valuations and statements. ResiFund’s team even take care of the boring stuff like admin, property maintenance and tenant management.

Resifund can make investing simple and accessible to everyone.

What is your track record?

Our sister-company OpenCorp has facilitated more than $1.2 Billion worth of property purchases for our direct property clients over 10 years and has achieved an average of over 10.8% p.a across all properties completed before 31/03/2018, including rent and capital growth on an ungeared basis. This excludes the development profits of Open Corp’s development funds and managed investment schemes, where Open Corp is the responsible entity and trustee of registered and unregistered managed investment schemes.

Allister Lewison has built a personal investment portfolio worth more than $74m and was named the 4thwealthiest self-made property millionaire in Australia under 40 years old; Cam Mclellan has purchased and developed hundreds of properties and is a best-selling author of ‘My 4-Year Old The Property Investor’, and Matt Lewison was responsible for managing a $2 BILLION property portfolio at just 26 years of age and has managed over 15 property funds, making more than $50million profit for clients in those funds.

What regulations am I covered by when I invest?

As ResiFund is a Fund Manager, we are licensed and regulated by the Australian Securities and Investments Commission (ASIC), to manage investments for investors such as yourself. This provides you with a range of protections. As part of that process, our Product Disclosure Statement (PDS) has also been lodged with ASIC.

What are the risks?

All investments carry at least a small amount of risk, even a term-deposit in a bank. The risks associated with investing in ResiFund are general fluctuations in the real estate market such as a steep drop in house prices and managing the borrowings we use to help us acquire properties. It should be noted though that the Australian residential property market has been stable and consistent compared with other asset classes such as the stock market, cryptocurrency or even commercial real estate. House prices may ebb and flow, however any temporary drops are regained over time as proven with decades of recorded data.

How do I get my money out?

Like any direct property investment, this should be seen as a medium to long term investment.

We expect investors to receive a significant part of their investment return every year, by receiving quarterly income distributions. In addition, any increase in the value of the properties, will be reflected in higher monthly unit prices.

We are also providing multiple options for investors to sell or redeem part or all of their investment in the Fund. This includes fixed liquidity dates for redemptions in addition to a number of other liquidity mechanisms. Refer to the PDS or speak to our consultants for further details.

What if the market crashes?

In the last 30 years to March 2018, we have only seen three negative quarters of returns and these were relatively modest falls. This compares to 26 negative quarters of returns from the Australian Stock market during the same period[ML1] . While past performance may not necessarily reflect future performance, Australian residential real estate has historically provided a lower risk for investors, relative to other investments[ML2] .

Notwithstanding, when markets significantly fall, all investments can be significantly impacted, be it Australian or international shares, commercial or residential property. Conversely, these periods of negative growth can also represent good buying opportunities.

Due to our significant focus on generating sustainable and growing income returns, through renting properties to a range of different tenants, we believe we can reduce the impact on your total investment return, should there be a fall in property values. In addition, as there is no requirement to necessarily sell property during market downturns, the Fund has a greater ability to manage through difficult market conditions.

[ML1]Source RIA

[ML2]Source RIA

What types of properties do you purchase?

The Fund will only invest in Australian residential property. While we are seeking to diversify the investments to reduce your risk by investing in a range of different types of residential property, the main goal of the fund is to generate rental income from the properties that ResiFund acquires.

These will include new single-family homes located in growth corridors in major cities. Along with these the fund will invest in multi tenancy properties. Multi-tenancy properties are residential properties that allow us to generate greater income as we are able to rent to more than one tenant. These may be in the form of duplexes, townhouses, or large residential buildings which offer a significant number of amenities such as pools, tennis courts, gyms and cafes. This can create a very attractive environment and community feel for tenants, encouraging tenants to stay for much longer than they might in typical rental properties, potentially providing higher income for building owners due to the additional services provided and the economies of scale.

Multi-tenancy properties are typically located in suburbs around 10-20km from CBD’s and close to transport, shopping and employment hubs.

Find Out How To Deleverage Your Portfolio & Begin Earning Positive Cash Flow In Retirement!

ResiFund Clients Love Us Because We Make Property Investment Effortless

The Rock-Solid ResiFund $1000 Offer

We understand you may feel skeptical about putting more money into property investing, so we’ve decided to make you a rock-solid offer. In the extremely unlikely event we can’t show you how to invest with as little as $1,000 – without another mortgage hanging over your head – in the next 30 days we’ll personally write you a cheque for $1,000 – hassle free, no questions asked.

Free, No Obligation 30-Minute Carefree Retirement Consultation + Investment Roadmap

We can show you how investors can use their existing property portfolio to earn more income, faster.

When you register for this free consultation, we’ll reveal:

- Why nearly 2 out of every 3 retired Australians rely on the age pension and how some are turning the tables, enjoying a carefree lifestyle and retiring early.

- Don’t work until you drop! The simple property strategy that could see you benefiting from the proceeds in the next 12 months!

- How investors can potentially remove the burden of debt from their assets and start earning positive cashflow from residential property.

- The one basic concept that successful investors continually use to give their families a leg up.

Why would we offer this for free? Naturally we know that a certain amount of people will want to move forward after they see how easy it is. And if you don’t come on board with us? No hard feelings – we’ll part ways as friends and you’ll have an increased knowledge of the Australian property market.

WARNING: Be quick! Spots with our investment experts are extremely limited, as we can only take on a small number of investors. Our consultants diaries are filling quickly so reserve your consultation today.

Find Out How ResiFund Can Help You Achieve Your Goals During Your Free Property Consultation

Find Out How ResiFund Can Help You Achieve Your Goals During Your Free Property Consultation  Secure Your Initial ResiFund Investment

Secure Your Initial ResiFund Investment Check Out The Progress Of Your Property Portfolio

Check Out The Progress Of Your Property Portfolio Supercharge Your ResiFund Returns

Supercharge Your ResiFund Returns