Sector Performance

By virtually any measure, the Australian residential property has been a very successful investment over the long term:

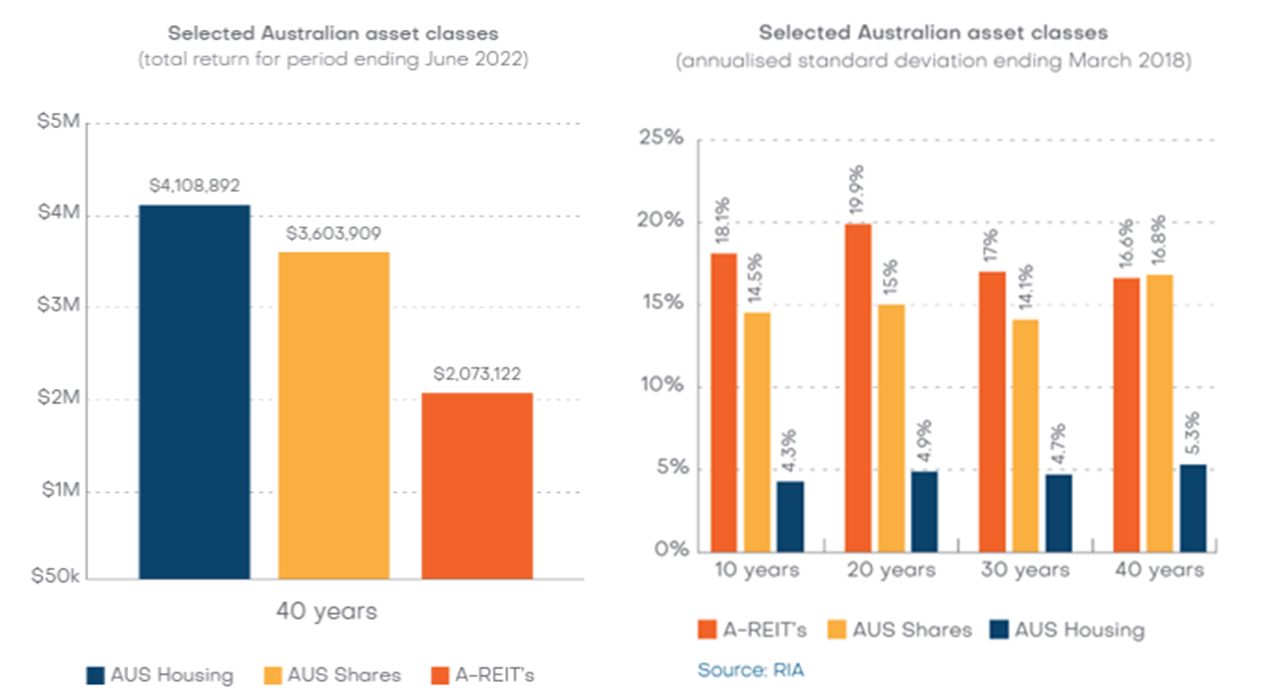

- Delivering an average return of 11.7% p.a in the 40 years to 30/6/2022*, and

- Being around 70% less volatile than the Australian Stock market over the same period*

To put those returns into further perspective, that is equivalent to having $50k invested in residential property increasing to over $4m over that period.

*Past performance is not indicative of future performance. Source RIA

This has resulted in residential property having higher returns and lower volatility compared to other major Australian investments, over virtually all periods of comparison.

The key reason the residential property sector has performed so well over such a long period of time, is quite simple. It is primarily due to the demand to both rent and buy properties being higher than the number of properties available. This then results in both rental and capital growth. The below graph helps highlight this, showing the long term population growth compared to the number of new building approvals. In particular, it highlights population growth from immigration now exceeding pre Covid levels while at the same time building approvals are trending down.

It is important to point out that past performance is not necessarily indicative of future performance.

Our view is that over the medium to long term, we are again likely see the demand to rent and buy properties exceeding supply. If that occurs, then we believe the residential property sector should continue to perform well which should enable ResiFund to continue to deliver attractive returns for our investors.

We highlight below some comparisons of residential property with other investments below.